Micron Technology is a leading company in the semiconductor industry, specializing in memory and storage products. The company is essential in the use of the most resources to fuel devices such as smartphones, computers, and data centres. Micron Technology stock has aroused the attention of both individual and institutional investors over the last few years.

Changes in the market, technological development, and global demand for chips also significantly affect its share price. With the increase of industries such as AI, 5G, and cloud computing, Micron is needed as a core element more than ever. Knowledge of prevailing market statistics, performance, and market outlook changes is pertinent in the decision-making process of investors. Using reliable sources like a Technology News Tracker can help investors stay updated with these shifts. This blog will shed light on the newest information so that you can find your way in the constantly changing world of the stock market.

Overview of Micron Technology’s Business Model

Micron Technology is the company that specializes in DRAM, NAND, and NOR Memory. Such products are needed when storing and processing information in different devices. Industries that use the company are consumer electronics, automotive, and cloud computing. It has higher research and development concentration, making its products competitive and high-performing.

Micron has a presence in all major markets with manufacturing facilities and customers located worldwide. The global presence has assisted the firm in accommodating variable supply and demand situations. The business model is centered on being innovative and efficient to remain profitable even in stalls in the market. Micron is an opportunity that investors see as a growth opportunity in the long term since the company has relevance in technologically-centered fields that are in high demand.

Current Market Trends Affecting Micron Technology Stock

There are high-paced changes in the semiconductor market. The new wave in AI and machine learning tools amplifies the demand for high-speed memory. The other force is the global growth of 5G networks. Meanwhile, factors like supply chain challenges and price tension might also interfere with production and pricing. The increased data center investments have helped Micron as the cloud service providers need higher-level storage solutions.

Nonetheless, the trends in the industry are cyclical, so the prices of memory chips may change. Analysts point to the flexibility and range of products Micron has to dampen the effects of walloping on the market. Investors ought to monitor not only the global economy but also the trends that are taking place in the semiconductor market.

Micron’s Recent Stock Performance Analysis

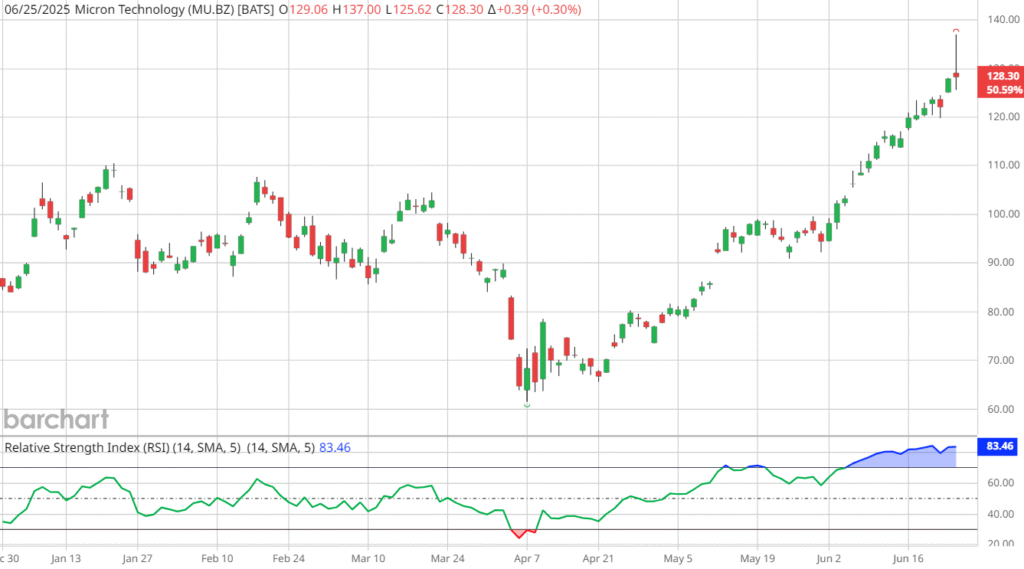

The share of Micron has managed to be resilient against the market. During the last year, its price was influenced by both the chip shortage in the world and increased demand in major industries. The revenue growth is consistent, and with better margins in a few quarters. Earnings reports issued by Micron are of great interest to investors, since they offer clues about the demand for products and product prices.

Due to the nature of the business, the stock tends to respond to the announcements relating to technological updates or significant supply contracts. Investors are also affected by the extent of dividends and buyback policies and financial stability. Although the short-term dynamics of the company are quite shaky, the long-term perspective of Micron’s development is encouraging because the demand for

Factors Driving Future Growth for Micron Technology

Several factors may drive Micron’s growth in the coming years. These include:

- Expansion of artificial intelligence and machine learning applications.

- Growing adoption of 5G technology across industries.

- Increased demand for automotive memory in electric and autonomous vehicles.

- Rising investment in cloud computing and data storage infrastructure.

- Development of more energy-efficient and high-capacity memory solutions.

These drivers indicate that Micron is well-positioned to benefit from technological advancements. Continued innovation and market diversification will be key to maintaining its competitive edge in the semiconductor industry.

Risks and Challenges in the Semiconductor Market

Although the future is favorable, Micron has challenges that investors are supposed to take into account. The semiconductor business is characterised as being very cyclical, where demand and prices depend on global economic conditions. The supply chain can be derailed by geopolitical issues, e.g, trade conflicts.

The threat of rivalry by other international chip firms is also highly competitive, as it makes the adventurous firms participate excessively in Research and Development. Rivalry also necessitates unremitting renovations regarding manufacturing facilities. The set of environmental regulations and sustainability objectives can raise the costs of the operation. The existence of these elements is why investors ought to approach at stock in Micron with a realistic attitude by acknowledging the growth potential and potential risks in the marketplace.

Expert Opinions and Investment Strategies

Micron possesses a positive long-term forecast by market analysts. The current position of the firm in emerging technologies is recommended to be considered by many who suggest a so-called buy-and-hold strategy. In short-term traders, one of the trends they would observe is a price fluctuation as a result of an earnings announcement.

Other experts advise on investing in other semiconductor stocks so as to cut down on the risks. Investors can time their entry and exit through monitoring key indicators that will assist them to close in on what is driving global chip demand, production capacity and technology trends. It is crucial to see Micron within the context of the high-tech industry to determine sound decisions concerning investment. Micron is a valid addition to any portfolio that concentrates on technology through attentive research.

FAQs

Is Micron Technology stock a good investment?

Yes, for long-term investors who believe in the growth of the semiconductor industry.

Does Micron pay dividends?

Yes, Micron offers dividends, though its primary focus remains on reinvestment and growth.

What industries use Micron’s products?

Micron serves sectors like consumer electronics, automotive, cloud computing, and artificial intelligence.

Conclusion

Micron Technology is a large company in the semiconductor industry whose products are all fundamental in the world of modern technology. Its share price captures the opportunities and the challenges in the industry, so it is worth being knowledgeable about its share price. Memories are also needed in the trends that the company enjoys such as AI, 5G, and cloud computing. Meanwhile, performance might be influenced by the dynamics of the market, competition and global problems. With the knowledge of the business model of Micron and its position in the market, as well as its drivers of growth, investors will make wiser decisions. Micron is one of the most relevant stocks in the technological investment field, and by monitoring its market dynamics, you would successfully thrive in it regardless of your investment position.

With three years of dedicated expertise in the niche of fish, my domain knowledge encompasses breeding, habitat maintenance, health management, and sustainable aquaculture practices, ensuring optimal outcomes in the aquatic realm.